UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934, as amended

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

ASCENDANT SOLUTIONS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:* |

| | (4) | Proposed maximum aggregate value of transaction: |

* Set forth amount on which the filing is calculated and state how it was determined.

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Ascendant Solutions, Inc. 16250 Dallas Parkway, Suite 100 |

16250 Dallas Parkway, Suite 205

|

Dallas, Texas 75248 |

972-250-0945 |

April 17, 200630, 2007

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 24, 2006June 14, 2007

Ascendant Solutions, Inc. ("Ascendant Solutions" or the "Company") will hold its Annual Meeting of Stockholders at 16250 Dallas Parkway, Suite 102, Dallas,the Addison Conference Centre, 15650 Addison Rd., Addison, Texas 7524875001 on May 24, 2006June 14, 2007 at 1:2:00 pm.

We are holding this meeting:

| 1. | To elect onetwo Class A directorB directors to hold office until the annual meeting of stockholders in the year 20092010 and until histheir successor isare elected and qualified; |

| 2. | To ratify the appointment of Hein & Associates LLP to be the Company’s independent auditors for fiscal year 2006;2007; |

| 3. | To transact any other business that properly comes before the meeting. |

Your board of directors recommends that you vote in favor of the proposalproposals outlined in this proxy statement.

Your board of directors has selected April 3, 200627, 2007 as the record date for determining stockholders entitled to vote at the meeting. A list of stockholders on that date will be available for inspection at Ascendant Solutions, Inc., 16250 Dallas Parkway, Suite 205,100, Dallas, Texas 75248, for at least ten days before the meeting.

This notice of annual meeting, proxy statement, proxy and our 20062007 Annual Report to Stockholders are being distributed on or about April 24, 2006.May 14, 2007.

You are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed Proxy as soon as possible in the envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she previously returned a Proxy.

By Order of the Board of Directors,

Gary W. BoydSusan K. Olson

|

Vice President-Finance andSecretary

|

Chief Financial Officer

|

YOUR VOTE IS IMPORTANT. PLEASE REMEMBER TO PROMPTLY RETURN YOUR PROXY CARD. |

QUESQUTIONSESTIONS AND ANSWERS

Q1:Who is soliciting my proxy?

| A: | We, the board of directors of Ascendant Solutions, Inc., are sending you this proxy statement in connection with our solicitation of proxies for use at the 20062007 Annual Meeting of Stockholders. Certain directors, officers and employees of Ascendant Solutions also may solicit proxies on our behalf by mail, e-mail, phone, fax or in person. |

Q2: | Who is paying for this solicitation? |

| A: | Ascendant Solutions will pay for the solicitation of proxies. Ascendant Solutions will also reimburse banks, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses in forwarding our proxy materials to the beneficial owners of Ascendant Solutions' common stock. |

Q3:What am I voting on?

·1. | A proposal to elect David E. BoweAnthony J. LeVecchio and Will Cureton as a Class A director.B directors. |

·2. | A proposal to ratify the appointment of Hein & Associates LLP to be the Company’s independent auditors for fiscal year 20062007. |

Q4:Who can vote?

| A: | Only those who owned common stock at the close of business on April 3, 2006,27, 2007, the record date for the Annual Meeting, can vote. If you owned common stock on the record date, you have one vote per share for each matter presented at the Annual Meeting. |

Q5:How do I vote?

| A: | You may vote your shares either in person or by proxy. To vote by proxy, you should mark, date, sign and mail the enclosed proxy in the enclosed prepaid envelope. Giving a proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person - by voting you automatically revoke your proxy. You also may revoke your proxy at any time before the voting by giving the Assistant Corporate Secretary of Ascendant Solutions written notice of your revocation at the address of the Company set forth in this proxy statement or by submitting a later-dated proxy. If you execute, date and return your proxy but do not mark your voting preference, the individuals named as proxies will vote your shares FOR the election of the nomineenominees for director.the Class B directors and the appointment of Hein & Associates LLP to be the Company’s independent auditors for the fiscal year 2007. |

Q6: | What constitutes a quorum? |

| A: | Voting can take place at the Annual Meeting only if stockholders owning a majority of the voting power of the common stock (that is a majority of the total number of votes entitled to be cast) are present in person or represented by effective proxies. On the record date, we had 22,396,80922,600,510 shares of common stock outstanding. Both abstentions and broker non-votes are counted as present for purposes of establishing the quorum necessary for the meeting to proceed. A broker non-vote results from a situation in which a broker holding your shares in "street" or "nominee" name indicates to us on a proxy that you have not voted and it lacks discretionary authority to vote your shares. |

| | Q7: | What vote of the stockholders will result in the matters being passed? |

| | A: | Election of Directors. Directors require a plurality of the votes cast in person or by proxy by the stockholders to be elected. Accordingly, abstentions and broker non-votes will have no effect on the outcome of the election of directors assuming a quorum is present or represented by proxy at the Annual Meeting. |

| | | Ratification of Independent Auditors.To ratify the appointment of Hein & Associates LLP as our independent auditors for the current fiscal year, stockholders holding a majority of the shares represented in person or by proxy at the meeting must vote in favor of this action. Abstentions have the same effect as votes “against” the proposal and broker non-votes have no effect at all. |

Q8. | What does it mean if I get more than one proxy card? |

| A: | If your shares are registered differently and are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all your shares are voted. We encourage you to have all accounts registered in the same name and address whenever possible. You can accomplish this by contacting our transfer agent, Securities Transfer Corporation at 469-633-0101 or by visiting their website at www.stctransfer.com. www.stctransfer.com. |

Q9: | How does the board recommend that I vote on the matters proposed? |

| A: | The board of directors of Ascendant Solutions unanimously recommends that stockholders vote FOR the nomineenominees to the board of directors and to ratify the appointment of Hein & Associates LLP as the Company’s independent auditors for fiscal year 20062007 as submitted at this year's Annual Meeting. |

Q10: | Where can I get a copy of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2005?2006? |

| A: | We will provide without charge a copy of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2005,2006, including the financial statements and the financial statement schedules, to each stockholder upon written request to Gary W. Boyd, Vice President-Finance and Chief Financial Officer,Susan K. Olson, Secretary, Ascendant Solutions, Inc., 16250 Dallas Parkway, Suite 205,100, Dallas, Texas 75248. This proxy statement and the 20052006 Annual Report on Form 10-K are also available on Ascendant's website at www.ascendantsolutions.com.www.ascendantsolutions.com (the contents of such website are not incorporated into this proxy statement). |

ELECTION OF DIRECTORS

Our business affairs are managed under the direction of the board of directors, or the Board, consisting of five persons, divided into three classes. Members of each class serve offset terms of three years so that only one class is elected each year. The following table sets forth each class, the directors comprising each class and their respective terms:

CLASS | DIRECTORS | TERM EXPIRING |

| | |

| Class A | David E. Bowe Jonathan R. BlochCurt Nonomaque

| 20062009 Annual Meeting |

| | |

| Class B | Anthony J. LeVecchio Will Cureton | 2007 Annual Meeting |

| | |

| Class C | James C. Leslie | 2008 Annual Meeting |

| | | |

Jonathan R. Bloch has elected to not stand for re-election as a Class A director at the 2006 Annual Meeting of Stockholders. The Board of Directors has not appointed a replacement for Mr.Curt Nonomaque to fill the Class A vacancy left by Jonathan R. Bloch’s vacant seat on the board of directors at this time. David E. Bowe isdirectors.

Anthony J. LeVecchio and Will Cureton are the only director nomineeClass B Director nominees on the proxy statement for the 20062007 Annual Meeting of Stockholders.

Richard L. Bloch, a Class B director resigned fromBased on its review of the applicable rules of The NASDAQ Global Market, the Board of Directors on February 16, 2005. Will Cureton was appointed as a director to fill the vacancy in the Class B directors created by Mr. Bloch's resignation. Class B directors, now consisting ofbelieves that Mr. LeVecchio and Mr. Nonomaque are "independent" within the meaning of The NASDAQ Global Market listing standards. According to these standards, the Board believes that Mr. Cureton, Mr. Bowe and Mr. Leslie are not “independent”. Additionally, according to these standards, Mr. Bloch, who served as a director until May 2006, was not “independent”.

Directors require a plurality of the votes cast in person or by proxy by the stockholders to be elected. Accordingly, abstentions and broker non-votes will continue to serve following this Annual Meetinghave no effect on the outcome of Stockholders forthe election of directors assuming a term that will expirequorum is present or represented by proxy at the Annual Meeting of Stockholders in 2007.Meeting.

The persons designated as proxies will vote the enclosed proxy for the election of the nominee unless you direct them to withhold your votes. If the nominee becomes unable to serve as a director before the meeting (or decides not to serve), the individuals named as proxies may vote for a substitute or we may reduce the number of members of the board. The Board recommends that stockholders vote FOR the nominee.nominees.

Below are the names and ages of the nomineenominees for Class A director,B directors, and the continuing Class BA and Class C directors, the years they became directors, their principal occupations or employment for at least the past five years and certain of their other directorships, if any.

Class B Directors

| · | Anthony J. LeVecchio Age 60, director since 2004. |

Mr. LeVecchio has been the President and owner of The James Group, a general business consulting firm that has advised clients across a range of high-tech industries, since 1988. Prior to forming The James Group in 1988, Mr. LeVecchio was the Senior Vice President and Chief Financial Officer for VHA Southwest, Inc., a regional healthcare system. Mr. LeVecchio currently serves as director, advisor and executive of private and public companies in a variety of industries. He currently serves on the Board of Directors of Microtune, Inc., a Dallas-based semiconductor company that is listed on The NASDAQ Global Market, and serves as the Chairman of its Audit Committee. He also currently serves on the Board of Directors of DG FastChannel, Inc., a technology company based in Irving, Texas that is listed on The NASDAQ Global Market and serves as the Chairman of its Audit Committee. He also currently serves on the Board of Directors of ViewPoint Financial Group, a community bank based in Plano, Texas that is listed on The NASDAQ Global Select Market. Mr. LeVecchio holds a Bachelor of Economics and a M.B.A. in Finance from Rollins College.

| · | Will Cureton Age 56, director since 2005. |

Mr. Cureton is a member and manager of CLB Holdings, LLC, a Texas limited liability company, which is the general partner of CLB Partners, Ltd., a Texas limited partnership ("CLB"), which is engaged in real estate development and which he co-founded in October 1997. Mr. Cureton is also a limited partner of CLB. Prior to co-founding CLB, Mr. Cureton was Chief Operating Officer of Columbus Realty Trust, a real estate investment trust, from 1993 to 1997. In 1987 Mr. Cureton co-founded Texana, a commercial real estate investment and property management company, and served as its President and Chief Executive Officer until 1993. From 1981 to 1987, Mr. Cureton served as an executive officer with The DicoGroup, Inc., a Dallas based real estate investment company. Mr. Cureton started his career with Coopers & Lybrand, where he worked from 1974 to 1981. Mr. Cureton received a Bachelor of Business Administration degree in accounting from East Texas State University (now known as Texas A&M University - Commerce).

Directors Continuing in Office Until the 2009 Annual Meeting

Class A Director

| · | David E. Bowe Age 47,48, director since 2000. |

Mr. Bowe has served as our Chief Executive Officer since August 2000, President since March 2000 and was our Chief Financial Officer from September 1999 to October 2004. Prior to accepting the position of President, Mr. Bowe also acted as our Executive Vice President from September 1999. Before joining us, Mr. Bowe served as President of U.S. Housewares Corporation (a consumer products company) from September 1998 to September 1999. Prior to that, Mr. Bowe was Executive Vice President of Heartland Capital Partners L.P. (a private equity firm) from 1993 to 1997 where he was responsible for making private equity investments. From 1987 to 1992, Mr. Bowe served in various executive capacities for The Thompson Company (a private investment firm) where he participated in the acquisition, development and operation of several portfolio companies. From 1980 to 1987, Mr. Bowe held various executive positions with Brown Brothers Harriman & Co. (a Wall Street private bank). Mr. Bowe received a BSBA in Finance from Georgetown University and is a Chartered Financial Analyst.

Directors Continuing in Office Until the 2007 Annual Meeting

Class B Directors

| · | Anthony J. LeVecchioCurt Nonomaque Age 58,49, director since 2004.2006.

|

Mr. LeVecchio has been theNonomaque is President and ownerChief Executive Officer of The James Group, a general business consulting firmVHA Inc., an Irving, Texas based, national health care provider alliance that has advised clients across a rangeoffers supply chain management services and helps member networks work together to identify and implement best practices to improve operational and clinical performance. From 1986 until his election as President and Chief Executive Officer in May 2003, Mr. Nonomaque held various finance and operating positions at VHA Inc. including Executive Vice President of high-tech industries, since 1988. Prior to forming The James Group in 1988, Mr. LeVecchio was the Senior Vice PresidentBusiness Operations and Chief Financial Officer, Vice President and Treasurer, Assistant Treasurer and Financial Analyst. Before joining VHA, Mr. Nonomaque served as a banking officer for VHA Southwest, Inc.,First City Bank in Dallas from 1985 to 1986. From 1983 to 1985, he was a regional healthcare system.management consultant with Arthur Andersen & Co. Mr. LeVecchio currently serves as director advisor, and executive of private and public companies in a variety of industries. He currently serves on the Board of Directors of Microtune, Inc., a Dallas-based semiconductor company that is listed on the Nasdaq National Market, and serves as the Chairman of its Audit Committee. He also currently serves on the Board of Directors of Digital Generation Systems, Inc., a technology company based in Irving, Texas that is listed on the Nasdaq National Market and serves as the Chairman of its Audit Committee. Mr. LeVecchio holdsNonomaque received a Bachelor of EconomicsArts degree in biology from Baylor University and also holds a M.B.A.Master’s degree in FinanceBusiness Administration from Rollins College.Baylor’s Hankamer School of Business.

· | Will Cureton Age 55, director since 2005.

|

Mr. Cureton is a member and manager of CLB Holdings, LLC, a Texas limited liability company, which is the general partner of CLB Partners, Ltd., a Texas limited partnership ("CLB"), which is engaged in real estate development and which he co-founded in October 1997. Mr. Cureton is also a limited partner of CLB. Prior to co-founding CLB, Mr. Cureton was Chief Operating Officer of Columbus Realty Trust, a real estate investment trust, from 1993 to 1997. In 1987 Mr. Cureton co-founded Texana, a commercial real estate investment and property management company, and served as its President and Chief Executive Officer until 1993. From 1981 to 1987, Mr. Cureton served as an executive officer with The DicoGroup, Inc., a Dallas based real estate investment company. Mr. Cureton started his career with Coopers & Lybrand, where he worked from 1974 to 1981. Mr. Cureton received a Bachelor of Business Administration degree in accounting from East Texas State University (now known as Texas A&M University - Commerce).

Class C Director

| · | James C. LeslieAge 50, a51, director since July 2001 and Chairman of the Board since March 2002 |

Board since March 2002.

Since March 2001, Mr. Leslie has focused primarily on managing his personal investments. Mr. Leslie has positions in one or more subsidiaries, or affiliates, of Ascendant. From 1996 through March 2001, Mr. Leslie served as President and Chief Operating Officer of The Staubach Company, a full-service international real estate strategy and services firm. From 1988 through March 2001, Mr. Leslie also served as a director of The Staubach Company. Mr. Leslie was President of Staubach Financial Services from January 1992 until February 1996. From 1982 until January 1992, Mr. Leslie served as Chief Financial Officer of The Staubach Company. Mr. Leslie serves on the board of Stratus Properties, Inc., a company that is listed on theThe NASDAQ NationalGlobal Market, and serves on boards of several private companies. Mr. Leslie holds a B.S. degree from The University of Nebraska and an M.B.A. degree from The University of Michigan Graduate School of Business.

All of the foregoing persons are currently directors. Their positions on standing committees of the Board of Directors are shown below under "Committees of the Board of Directors; Meetings".

There are no family relationships among the executive officers or directors. There are no arrangements or understandings pursuant to which any of these persons were elected as an executive officer or director.

Other Executive Officers

Michal L. Gayler, 48, has served as our Interim Chief Financial Officer since September 2006. From 2003 to present, Mr. Gayler has served as President of GaylerSmith Group LLC, a financial consulting firm. From 2001 to 2003, Mr. Gayler served as Vice President of Buis & Co., an investment consulting firm. Prior thereto, Mr. Gayler served in a number of senior financial executive positions in a variety of industries. Mr. Gayler started his business career as an auditor with Coopers & Lybrand (now PricewaterhouseCoopers), an international public accounting firm. Mr. Gayler graduated from Texas Tech University with a BBA in Accounting and is a certified public accountant.

Gary W. Boyd, 4041, has served as our Vice President-Finance and Chief Financial Officer sincefrom October 2004.2004 until September 2006. From 1987 to 1994, Mr. Boyd was an accountant with Coopers & Lybrand, LLP, serving as an audit manager from 1991 to 1994. From 1994 to 1996, Mr. Boyd was the controller of Summit Acceptance Corporation, a national financial services company, and from 1996 to 2000, Mr. Boyd served as the Chief Financial Officer and Secretary of Summit Acceptance Corporation. From 2001 to 2002, Mr. Boyd was the Vice President - Finance of PARAGO, Inc., a technology based service provider to the promotions management industry. From January 2003 until he joined the Company, Mr. Boyd was the Vice President-Finance of CountryPlace Mortgage, Ltd., a subsidiary of Palm Harbor Homes, Inc., a company listed on theThe NASDAQ Global Market that manufactures, markets and finances multi-section manufactured and modular homes. Mr. Boyd received a Bachelor of Business Administration degree from Baylor University in 1987 and is a certified public accountant.

COMPENSATION OF DIRECTORS

As of DirectorsMay 11, 2006

Annual Cash Retainer | Per Meeting Fees | Initial Stock Grant | Annual Stock Grant | Restricted Stock Grant |

| | | | |

| Non Employee Director $20,000 | In person $500, telephonic $250 | 10,000 shares | 7,500 shares annually in May | 7,500 shares per year of service (3 year minimum, 10 year maximum) |

| Audit Committee Chairman $15,000 | In person $500, telephonic $250 | | | Effective for service starting May 2006 |

| 1. | All payment and share issuance terms were effective as of July 1, 2006 |

| 2. | Payment of Cash Retainer is made on the 1st day of each fiscal quarter, beginning July 1, 2006 |

| 3. | Board members may elect to receive restricted common shares in lieu of cash retainer on a quarterly basis. |

| 4. | Elections to receive restricted common shares in lieu of cash retainers will be based on the stock closing price on the 1st day of the fiscal quarter. Shares will vest as of the end of the quarter in which they were issued. |

Non-employee directors (excluding Mr. LeVecchio) are compensated $500 for each board meeting attended in person and $250 for each board meeting attended telephonically. Mr. LeVecchio is compensated $8,750 per quarter for his services as a member of the Board of Directors and as Chairman of the Audit Committee. During 2005, Mr. LeVecchio was paid $8,750 in cash and elected to receive 17,500 shares of restricted stock for the remainder of his 2005 director compensation. These shares vested pro-rata at the end of the quarters ending June, September and December 2005. Additionally, Mr. Bloch and Mr. Cureton received 2,500 shares each in lieu of cash compensation for their attendance at the 2005 board meetings. These shares also vested pro-rata at the end of the quarters ending June, September and December 2005.2006 Director Compensation Table

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

James C. Leslie | 50,000 | | | | | -- | 50,000 |

Will Cureton | 1,000 | 10,000 | | | | -- | 11,000 |

Curt Nonomaque | 250 | 5,000 | | | | | 5,250 |

Anthony J. LeVecchio | 1,250 | 35,875 | | | | -- | 37,125 |

Jonathan R. Bloch | | | | | | | |

Notes:

| · | On February 13, 2006, Anthony J. LeVecchio was awarded 15,909 shares of restricted common stock that vested at the end of the first quarter of 2006. The stock price at the date of grant was $0.55. |

| · | On April 18, 2006, Anthony J. LeVecchio was awarded 14,808 shares of restricted common stock that vested at the end of the second quarter of 2006. The stock price at the date of grant was $0.65. |

| · | On July 3, 2006, Anthony J. LeVecchio was awarded 14,113 shares and Will Cureton was awarded 8,065 shares, respectively, of restricted common stock that vested at the end of the third quarter of 2006. The stock price at the date of grant was $0.62. |

| · | On July 26, 2006, Anthony J. LeVecchio was awarded 7,500 shares of restricted common stock, such stock vesting equally over a period of three years on the anniverary of the date of grant. The stock price at the date of grant was $0.50. |

| · | On September 12, 2006, Curt Nonomaque was awarded 10,000 shares of restricted common stock, such stock vesting equally over a period of three years on the anniverary of the date of grant. The stock price at the date of grant was $0.41. |

| · | On October 2, 2006, Anthony J. LeVecchio was awarded 21,875 shares, Will Cureton was awarded 12,500 shares, Curt Nonomaque was awarded 12,500 shares, respectively, of restricted common stock that will vest at the end of the fourth quarter. The stock price at the date of grant was $0.40. |

| · | During 2006, Anthony J. LeVecchio was awarded an aggregate of 74,205 shares of restricted common stock, Will Cureton was awarded an aggregate of 20,565 shares of restricted common stock and Curt Nonomaque was awarded an aggregate of 22,500 shares of restricted common stock. |

Our directors are also eligible to receive stock option grants under our 1999 Long-Term Incentive Plan and our 2002 Equity Incentive Plan. For descriptions of the 1999 Long-Term Incentive Plan and the 2002 Equity Incentive Plan, please see the discussions set forth in the section titled "Management."Equity Incentive Plans." In addition, James C. Leslie, Chairman of the Board, was paid an annual retainer of approximately $50,000 for his service as Chairman of the Board in 2005.2006.

During the year ended December 31, 2005,2006, the entire Board met nineeight times and acted fivethree times by unanimous written consent. During fiscal 2005,2006, no director attended fewer than 75% of the aggregate number of meetings of the Board and committees on which such director served.

The Board has three standing committees, the Audit Committee, the Compensation Committee and the Related Party Transactions Committee. The Board does not have a separate Nominating Committee and performs all of the functions of that committee.

The Audit Committee. The Audit Committee has as its primary responsibilities the appointment of the independent auditor for the Company, the pre-approval of all audit and non-audit services, and assistance to the Board in monitoring the integrity of our financial statements, the independent auditor's qualifications, independence and performance and our compliance with legal requirements. The Audit Committee operates under a written charter adopted by the Board, a copy of which is available on the Company's website at www.ascendantsolutions.com.www.ascendantsolutions.com (the contents of such website are not incorporated into this proxy statement). During the year ended December 31, 2005,2006, the Audit Committee met five times. Jonathan R. Blochtimes and acted one time by written consent. Curt Nonomaque (as of September 2006) and Anthony J. LeVecchio are the current members of the Audit Committee, but Mr.Committee. Jonathan Bloch has elected not to not stand for re-election as a Class A director and,at the 2006 Annual Meeting therefore, after the 2006 Annual Meeting will no be athere was only one member of the Audit Committee.Committee until Mr. Nonomaque took his vacancy.

The Securities and Exchange Commission ("SEC") has adopted rules to implement certain requirements of the Sarbanes-Oxley Act of 2002 pertaining to public company audit committees. One of the rules adopted by the SEC requires a company to disclose whether the members of its Audit Committee are "independent." Since we are not a "listed" company, we are not subject to rules requiring the members of our Audit Committee to be independent. The SEC also requires a company to disclose whether it has an "Audit Committee Financial Expert" serving on its audit committee.

Based on its review of the applicable rules of The Nasdaq NationalNASDAQ Global Market governing audit committee membership, the Board believes that Mr. LeVecchio isand Mr. Nonomaque are "independent" within the meaning of NasdaqThe NASDAQ Global Market listing standards, but does not believe thatwhereas, Mr. Bloch iswas not "independent" within the meaning of such rules. The Board does believe that both members of the Audit Committee satisfy the general definition of an independent director under Nasdaq'sThe NASDAQ Marketplace Rule 4200, but Mr. Bloch fails to satisfy the more stringent requirements applicable to audit committees under Rule 4350 in view of Richard L. Bloch's beneficial ownership of 15.6% of our common stock and Jonathan Bloch's family relationship with Richard Bloch.4200.

Based on its review of the criteria of an Audit Committee Financial Expert under the rule adopted by the SEC, the Board, after reviewing all of the relevant facts, circumstances and attributes, has determined that Mr. LeVecchio, the Chairman of the Audit Committee, is the soleand Mr. Nonomaque are both qualified as an "audit committee financial expert" on the Audit Committee.

Compensation Committee. The Compensation Committee recommends to the Board annual salaries for senior management and reviews all company benefit plans. The Compensation Committee operates under a written charter adopted by the Board, a copy of which is available on the Company's website at www.ascendantsolutions.com (the contents of such website are not incorporated into this proxy statement). The Compensation Committee did not have any formal meetings in 2006 but acted one time by written consent. During the year ended December 31, 2005, the Compensation Committee had no formal meetings, instead2006, the full Board performed these functions.the functions of the Compensation Committee. The current members of the Compensation Committee are Jonathan R. BlochCurt Nonomaque, the Chairman of the Compensation Committee, and Anthony J. LeVecchio, but Mr. Bloch has elected to not stand for re-election asLeVecchio. After a Class A director and, after the Annual Meeting will no be a memberreview of the Compensation Committee. .applicable rules of The NASDAQ Global Market governing compensation committee membership, the Board believes that Mr. LeVecchio and Mr. Nonomaque are “independent” within the meaning of The NASDAQ Global Market Listing Standards.

Related Party Transactions Committee. The Related Party Transactions Committee was created on February 15, 2005 and is responsible for the review of all related party transactions for potential conflict of interest situations on an ongoing basis, including transactions with management, certain business relationships, and indebtedness of management. In reviewing a proposed transaction, the Related Party Transaction Committee must (i) satisfy itself that it has been fully informed as to the related party’s relationship and interest and as to the material facts of the proposed transaction and (ii) consider all of the relevant facts and circumstances available to the committee. After its review, the Related Party Transaction Committee will only approve or ratify transactions that are fair to the Company and not inconsistent with the best interests of the Company and its stockholders. The current members of the Related Party Transactions Committee are Jonathan R. Bloch and Anthony J. LeVecchio.LeVecchio and Curt Nonomaque. The Related Party Transactions Committee had no formal meetings during the year ended December 31, 2005.2006.

Nomination Process.The Board does not have a separate Nominating Committee or Charter and performs all of the functions of that committee. The Board believes that it does not need a separate nominating committee because the full Board is relatively small, has the time to perform the functions of selecting Board nominees and in the past has acted unanimously in regard to nominees. The Board has also considered that two of its members, Will Cureton and James C. Leslie, constitute two of the three persons who have voting control with respect to 7,948,8007,997,976 shares of common stock, or 35.5% of the shares entitled to vote, as discussed in the footnotes in "Stock Ownership."

In view of Ascendant's size, resources and limited scope of operations, the Board has determined that it will not increase the size of the Board from its current size of five members, althoughmembers. Although the Board will havehad one vacancy. Uponvacancy, with the expiration of Jonathan R. Bloch’s term of office at the 2006 Annual Meeting, the Board will consistconsisted of only four members. In September 2006, Curt Nonomaque filled the vacancy caused by Mr. Bloch’s resignation, the size of the Board increased back to five members. In the future, the Board may determine that increased size, scope of operations or other factors would make it advisable to add additional directors. In considering an incumbent director whose term of office is to expire, the Board reviews the director's overall service during the person's term, the number of meetings attended, level of participation and quality of performance. In the case of new directors, the directors will consider suggestions from many sources, including stockholders, regarding possible candidates for directors. The Board may engage a professional search firm to locate nominees for the position of director of the Company. However, to date the Board has not engaged professional search firms for this purpose. A selection of a nominee by the Board requires a majority vote of the Company's directors.

The Board seeks candidates for nomination to the position of director who have excellent decision-making ability, business experience, personal integrity and a high reputation and who meet such other criteria as may be set forth in a writing adopted by a majority vote of the Board of Directors. The committee will use the same criteria in evaluating candidates suggested by stockholders as for candidates suggested by other sources.

Pursuant to a policy adopted by the Board, the directors will take into consideration a director nominee submitted to the Company by a stockholder; provided that the stockholder submits the director nominee and reasonable supporting material concerning the nominee by the due date for a stockholder proposal to be included in the Company's proxy statement for the applicable annual meeting as set forth in the rules of the Securities and Exchange Commission then in effect. See "Annual Meeting Advance Notice Requirements" below.

Director Attendance at Annual Meetings.Meetings

We do not have a policy regarding attendance by members of the Board of Directors at our annual meeting of stockholders. The Board has always encouraged its members to attend its annual meeting. In 2005,2006, four directors (Mr. Leslie, Mr. Bowe, Mr. Cureton and Mr. LeVecchio) attended our annual meeting of stockholders.

Stockholder Communications With The Board. Board

Historically, we have not had a formal process for stockholder communications with the Board. We have made an effort to ensure that views expressed by a stockholder are presented to the Board. During the upcoming year, the Board may give consideration to the adoption of a formal process for stockholder communications with the Board.

CODE OF BUSINESS CONDUCT AND ETHICS

Code of Business Conduct and Ethics.The Board adopted a Code of Business Conduct and Ethics on May 19, 2004, a copy of which is available on the Company's website at www.ascendantsolutions.com.

www.ascendantsolutions.com (the contents of such website are not incorporated into this proxy statement).

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers

The following table sets forth information with respect to the beneficial ownership of our common stock at March 31, 2006,2007, by:

| · | each of our named executive officerofficers and directors; |

| · | all of our executive officers and directors as a group; and |

| · | each person or group of affiliated persons, known to us to own beneficially more than 5% of our common stock. |

In accordance with the rules of the SEC, the table gives effect to the shares of common stock that could be issued upon the exercise of outstanding options and common stock purchase warrants within 60 days of March 31, 2006.2007. Unless otherwise noted in the footnotes to the table, and subject to community property laws where applicable, the following individuals listed in the table have sole voting and investment control with respect to the shares beneficially owned by them. Unless otherwise noted in the footnotes to the table, the address of each stockholder, executive officer and director is c/o Ascendant Solutions, Inc., 16250 Dallas Parkway, Suite 205,100, Dallas, Texas 75248. We have calculated the percentages of shares beneficially owned based on 22,396,80922,549,836 shares of common stock outstanding at March 31, 2006.2007.

| | | Shares of Common Stock Beneficially Owned | |

Person or group | | Number | | Percent | |

| | | | | | |

David E. Bowe (1) | | | 1,175,250 | | | 5.1 | % |

Jonathan R. Bloch (2) | | | 242,500 | | | 1.1 | % |

James C. Leslie (3) | | | 4,446,300 | | | 19.9 | % |

CLB Partners, Ltd. (4) | | | 3,500,000 | | | 15.6 | % |

Will Cureton (5) | | | 3,520,000 | | | 15.7 | % |

Anthony J. LeVecchio | | | 135,359 | | | * | |

Gary W. Boyd | | | 59,000 | | | * | |

All executive officers and directors as a group (6 persons)(6) | | | 9,578,409 | | | 41.5 | % |

| | | | | | | | |

| | Shares of Common Stock Beneficially Owned |

Person or group | Number | Percent |

David E. Bowe (1) | 1,175,250 | 5.2% |

James C. Leslie (2) | 4,446,300 | 19.7% |

Will Cureton (3) | 3,551,676 | 15.8% |

CLB Partners, Ltd.(3) | 3,500,000 | 15.5% |

Anthony J. LeVecchio | 213,099 | * |

Gary W. Boyd | 69,000 | * |

Curt Nonomaque | 33,611 | * |

Michal L. Gayler | 12,000 | * |

All executive officers and directors as a group (7 persons)(4) | 9,500,936 | 42.1% |

| (1) | Includes 20,000 shares held by Mr. Bowe's wife, 20,250 shares held by Mr. Bowe as custodian for minor children and 450,000 shares that may be acquired upon exercise of currently exercisable options with an exercise price of $0.24 per share. |

| (2) | Includes 235,000 shares of common stock that may be acquired upon exercise of currently exercisable options and 5,000 shares of common stock held by Jonathan R. Bloch's wife. |

(3) | Includes 55,000 shares held by James C. Leslie as custodian for minor children. |

(4) | CLB Holdings LLC, a Texas limited liability company, is the general partner of CLB. Will Cureton, a director, and Richard L. Bloch are the managers of CLB Holdings LLC and the Richard and Nancy Bloch Family Trust and Will Cureton are the members of CLB Holdings LLC. Richard L. Bloch is a co-trustee of The Richard and Nancy Bloch Family Trust. Additionally, Richard Bloch, Nancy Bloch, the Richard and Nancy Bloch Family Trust and Will Cureton are also limited partners of CLB. The address of CLB is 16250 Dallas Parkway, Suite 201, Dallas, Texas 75248. |

(5)(3) | Represents 3,500,000 shares owned of record by CLB. Mr. Cureton's address is 16250 Dallas Parkway, Suite 201, Dallas, Texas 75248. |

(6)(4) | Includes 685,000450,000 shares of common stock that may be acquired upon exercise of currently exercisable stock options, and the options and shares held by Jonathan R. Bloch who is not standing for re-election.options. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under U.S. securities laws, directors, certain executive officers and persons holding more than 10% of our common stock must report their initial ownership of the common stock, and any changes in that ownership, to the SEC. The SEC has designated specific due dates for these reports. Based solely on our review of copies of the reports filed with the SEC and written representations of our directors and executive officers, we believe that all persons subject to reporting filed the required reports on time in 2005,2006, except that James C. Leslie reported a gift of shares made to his minor childrenCurt Nonomaque was issued restricted stock on June 18, 2004 on a Form 4 filed September 12, 2005.2006 and it was reported on September 26, 2006; and on October 2, 2006, restricted stock was issued to Anthony J. LeVecchio, Will Cureton and Curt Nonomaque and it was reported on November 7, 2006.

-10-COMPENSATION DISCUSSION AND ANALYSIS

MANAGEMENTthe Board of Directors. The Compensation Committee, which is composed of non-employee directors, is responsible for approving and reporting to the Board on all elements of compensation for the elected corporate officers. The Compensation Committee did not have any formal meetings in 2006 but acted one time by written consent. During the year ended December 31, 2006, the full Board performed the functions of the Compensation Committee.

In December 2001, the Company revised its strategic direction to seek acquisition possibilities throughout the United States, make acquisitions or enter into other business endeavors. As a result of two acquisitions in 2004 and other investment activity, the Company will evaluate its need to hire additional executive officers in fiscal 2007 and beyond. To the extent that the Company makes a determination to hire additional executive officers, a compensation package will be offered that is consistent with the policies of the Compensation Committee. The general policies of the Compensation Committee are set forth below.

Executive OfficersObjectives of Compensation Programs

Our goal is to attract, retain and reward highly competent and productive executive officers by ensuring that the total compensation packages for our executive officers are fair, reasonable and competitive. Currently, David E. Bowe, and Gary W. Boyd.

Executive Compensation

Summary compensation. The following table provides summary information concerning compensation paid by us to David E. Bowe, our President and Chief Executive Officer, Michal L. Gayler, Interim Chief Financial Officer, and Gary W. Boyd, ourpast Vice President-Finance and Chief Financial Officer, (the "namedare our only named executive officers").officers. In 2005, no other person who servedSeptember 2006, Mr. Boyd resigned from the Company and Mr. Gayler was appointed to serve as anthe Company’s Interim Chief Financial Officer.

We expect that any future executive officerofficers of Ascendant Solutions at any time during the year had total annualCompany would be eligible to receive compensation packages that include a mix of base salary and bonuslong-term incentive opportunities and other employee benefits. The compensation arrangements for our named executive officers are designed to satisfy two core objectives:

retain, motivate and attract executives of the highest quality in excesskey positions in the various business segments of $100,000. In 2002, David E. Bowe's salary was reducedour company; and he was awarded certain performance-based options and restricted stock,

align the interests of the named executive officers with those of our stockholders by rewarding performance above our established goals, with the ultimate objective of improving stockholder value.

Furthermore, we believe that the long-term success of our Company requires that our named executive officers make decisions that in part, in exchangethe short-term may not contribute to our financial performance, but will prepare our Company for the reductionfuture. We, therefore, do not look solely at short-term financial achievements in salary to be paid to him. See "Compensation Committee Report - Chief Executive Compensation."

| | Annual Compensation

| Long-Term

Compensation Award

| |

Name and Principal Positions

| Year

| Salary

($)

| Bonus

($)

| Restricted Stock Awards

($)

| Securities Underlying Options

(#)

| All Other Compensation

($)

|

| | | | | | |

David E. Bowe

President and Chief Executive Officer

| 2005

2004

2003

| $100,000

$100,000

$100,000

| --

--

--

| --

--

--

| --

--

--

| --

$4,000(1)

$1,333(1)

|

Gary W. Boyd

Vice President-Finance and Chief Financial Officer

| 2005

2004

2003

| $150,000

$31,250(2)

--

| --

$15,000

--

| --

$55,000(2)

--

| --

--

--

| --

--

--

|

(1)Represents the amount of matching contribution made by us in such fiscal year underdetermining appropriate compensation for our 401(k) Plan and in which our employees participate.

(2) Represents the portion of Mr. Boyd's annual salary for the fiscal year ended December 31, 2004 since his employment commenced in October 2004. Mr. Boyd was granted 50,000 shares of restricted common stock, which vest in three equal annual installments. At December 31, 2005, these shares of restricted stock had a market value of $30,000.

named executive officers but take into account their long-range planning.

Option Grants in Last Fiscal Year. There were no option grants during the fiscal year ended December 31, 2005.Elements of Compensation

Our named executive officer compensation packages currently consist of base salary and equity incentive compensation which are intended to provide our named executive officers with aggregate compensation packages that satisfy the core objectives set forth above. At this time, we do not provide named executive officers with any supplemental retirement benefits, qualified pension plans or deferred compensation plans other than the 401(k) plan to which the named executive officers may contribute.

Aggregated Option ExercisesDetermination of Compensation

The Compensation Committee has primary authority for determining the compensation awards to be made to our executive officers. The Compensation Committee annually determines the total compensation levels for our executive officers by considering several factors, including each executive officer’s role and responsibilities, how the executive officer is performing against those responsibilities, and our performance.

The Compensation Committee has elected not to retain an independent compensation consultant to advise the Compensation Committee on executive compensation policies and practices.

Base Salary

We establish base salaries that are sufficient, in Last Fiscal Yearthe judgment of the Board of Directors, to retain and Fiscal Year-End Option Values. The following table provides information regarding options that were exercised duringmotivate our named executive officers. In determining appropriate salaries, we consider each named executive officer’s scope of responsibility and accountability within our Company and review the fiscal year ended December 31, 2005,named executive officer’s compensation, individually and relative to other officers. Changes in compensation are typically based on the number of shares covered by both exercisable and unexercisable stock options as of December 31, 2005,individual's performance, Ascendant Solutions' financial performance, and the values of "in-the-money" options, which values representcompetitive marketplace. Currently, we do not utilize any formal mathematical formula or objective thresholds in determining base salary adjustments. We believe that strict formulas restrict flexibility and are too rigid as the positive spread betweenCompany continues working through its acquisition and other business strategies.

In June 2006, Mr. Bowe’s annual salary was increased from approximately $100,000 to $150,000 annually and Mr. Boyd’s annual salary was increased from approximately $150,000 to $180,000 annually. Mr. Gayler is not a salaried employee.

Equity Incentive Compensation

We believe that our equity incentive compensation arrangements are an important factor in developing an overall compensation program that aligns the exercise price of any such option and the fiscal year-end valueinterests of our commonnamed executive officers with those of our stockholders. We generally award shares of restricted stock to executive officers and other key employees at the time of initial employment, at promotion and at discretionary intervals thereafter. Grants of restricted stock vest over a period of years in order to serve as an inducement for the named executive officers to remain in the employ of our Company. It is contemplated that we will continue to offer restricted stock as the principal component of our equity compensation arrangement for our named executive officers.

| | Shares Acquired on | Value | Number of securities underlying unexercised options at fiscal year-end | Value of the unexercised in-the-money options at fiscal year-end |

Name | Exercise | Realized | Exercisable | Unexercisable | Exercisable | Unexercisable |

| | | | | | | |

| David E. Bowe | 100,000 | $42,000 | 450,000 | -- | $162,000 | $-- |

The Company has two plans from which it may make equity incentive awards:

Our 1999 Long-Term Incentive Plan, approved by the board of directors on May 12, 1999, and subsequently amended, currently provides for the issuance to qualified participants of up to 2,500,000 shares of our common stock pursuant to the grant of stock options.. The purpose of ourthe 1999 Long-Term Incentive Plan is to promote our interests and the interests of our stockholders by using investment interests in Ascendant Solutions, Inc.common stock to attract, retain and motivate eligible persons, to encourage and reward their contributions to the performance of Ascendant Solutions, and to align their interests with the interests of our stockholders. AsOur directors, officers, employees, consultants and advisors are eligible to receive grants under this plan. With respect to all of March 31,our employees other than directors and executive officers, the Compensation Committee has the authority to administer the plan, including the discretion to determine which eligible persons will be granted stock options, the number of shares subject to options, the period of exercise of each option and the terms and conditions of such options. The entire board of directors administers the plan for directors and executive officers. No grants of stock options were made during fiscal 2006 unexercised options to purchase 715,000 shares of common stock were outstanding, having a weighted average exercise price of $0.26 per share, underthe executive officers pursuant to the 1999 Long-Term Incentive Plan. Of these, options to purchase 10,000 shares of common stock are intended to qualify as Incentive Stock Options under Section 422 of the Code. The remaining options to purchase 705,000 shares of common stock are nonqualified stock options.

The outstanding and unexercised options include 235,000 that were granted to Jonathan R. Bloch on March 14, 2002 at an exercise price of $0.24 per share. These options are exercisable in three installments beginning in March 2003 and expire in 2012. The outstanding options also include 450,000 options remaining out of the 600,000 performance based options granted to David E. Bowe on March 14, 2002, at an exercise price of $0.24 per share. The performance based options vest annually over six years beginning in March 2003 with the potential to vest earlier upon achievement of pre-established performance goals. In May 2004, these performance goals were achieved and the Company’s Board of Directors accelerated the vesting of the remaining unvested options.

The board of directors adopted the 2002 Equity Incentive Plan on March 14, 2002 and the stockholders approved it at the 2002 Annual Meeting.. The purpose of the 2002 Equity Incentive Plan is to provide a means by which selected employees of and consultants to the Company and its affiliatessubsidiaries may be given an opportunity to acquire a proprietaryan equity interest in Ascendant Solutions. Our employees, officers, directors, consultants and other persons are deemed to have contributed or to have the Company. Underpotential to contribute to our success. The 2002 Equity Incentive Plan is administered by our Compensation Committee or in its absence, by the Board During 2006, 117,270 shares of restricted stock were issued to directors under the 2002 Equity Incentive Plan as part of their compensation for serving as members of the Company may provide various typesboard of long-term incentive awards, including Options, Stock Appreciation Rights, Restricted Stock, Deferred Stock, Stock Reload Options and Other Stock-Based Awards, in order to retain the services of persons who are now employees of or consultants to the Companydirectors and its affiliates,committees. Also, 10,000 shares of restricted stock were issued to secureGary Boyd, former Vice President - Finance and retainChief Financial Officer, as part of his compensation.

No grants under the services of new employees and consultants, and to provide incentives for such persons to exert maximum efforts for1999 Long-Term Incentive Plan or the success of the Company and its affiliates. The 2002 Equity Incentive Plan were made to our named executive officers during fiscal 2006.

Stock Option Grant Practices

While we do not currently provides for the issuance of awards of upgrant stock options to 2,000,000 sharesour executive officers, we have previously used stock options as part of our common stock. Asoverall compensation program and may do so in the future. Awards of March 31, 2006, 565,909 sharesoptions are approved by the Board or the Compensation Committee. It is the general policy of restrictedthe Company that the grant of any stock had beenoptions to eligible employees occurs without regard to the timing of the release of material, non-public information. Under the Company’s 2002 Equity Incentive Plan, the exercise price of options is determined by the plan administrator, and options may generally be granted underat an exercise price that is greater than or less than the fair market value (as defined in the 2002 Equity Incentive Plan.

We do not currently have any stock ownership guidelines or requirements in place for our named executive officers. However, we anticipate that the issuance of restricted shares to our named executive officers and other executives will over time increase the number of shares of Company stock held by them. The ownership of actual shares should further serve to align the interests of the named executive officers and other executives with our stockholders.

Perquisites and Employee Benefits

Effective January 1, 2005, the Company established a new 401(k) plan to cover all of its employees, and it terminated the old 401(k) plans related to the acquired entities, CRESA Partners of Orange County, LP (“CPOC”) and Dougherty’s Holdings and Subsidiaries (“DHI”). The terms of the new plan are substantially the same as the terms of the 401(k) plans of its acquired subsidiaries. Under

Our named executive officers are eligible to participate in all of our employee benefit plans, such as our 401(k) Plan and medical, dental, and group life insurance plans, in each case on the termssame basis as our other employees. In 2006, in addition to providing medical, dental, and group life insurance to our named executive officers, we also contributed to the 401(k) Plan accounts of the new plan, theeach of our named executive officers. Our Company has the option to match employee’s contributions to the 401(k) plan in an amount and at the discretion of the Company. During the year ended December 31, 2005,2006, the Company made matching contributions of $19,000approximately $24,878 to the new 401(k) plan.plan to employees of CPOC. None of such contributions were for the accounts of our named executive officers.

Pension Benefits

The Company does not have a pension or retirement plan other than the 401(k) plan (described above).

Executive Compensation

David E. Bowe. Mr. Bowe's salary is not currently covered by an employment agreement however, in March 2002, the Board approved a salary in the amount of approximately $100,000 be paid to Mr. Bowe. In March 2002, the Company granted to Mr. Bowe 600,000 performance-based options under its 1999 Long-Term Incentive Plan for an exercise price of $0.24 per share and 425,000 shares of restricted stock under the Company's 2002 Equity Incentive Plan at $0.24 per share. The award of these performance-based options and restricted stock to Mr. Bowe was made, in part, in light of a reduction in salary paid to Mr. Bowe that was made to reduce corporate cash expenses. No grants under the 1999 Long-Term Incentive Plan or the 2002 Equity Incentive Plan were made to Mr. Bowe during fiscal 2006.

During the calendar year 2006, the Compensation Committee determined and the Board agreed to increase Mr. Bowe’s base salary from approximately $100,000 to $150,000. When evaluating Mr. Bowe's contributions to the Company for the past fiscal year the Compensation Committee considered, among other things, the performance of the Company’s recent acquisitions, its investments, and the continued pursuit of other acquisitions and investment opportunities.

Michal L. Gayler. Mr. Gayler is an Interim Chief Financial Officer and works on a contract basis. During September though December of 2006, he was paid approximately $57,499. Mr. Gayler is paid based on hours worked and is compensated at the rate of $95 per hour. Mr. Gayler is not considered an employee of the Company and acts as an independent contractor. The Company does not provide Mr. Gayler with any health or major medical benefits.

Mr. Gayler served as a business consultant to the Company from May 2005 to September 2006. For hourly consulting services rendered during fiscal year 2005, the Company paid Mr. Gayler a total of $1,211, Fairways Equities LLC, an affiliate of the Company, paid Mr. Gayler a total of $53,570 and Dougherty’s Holdings, Inc., a subsidiary of the Company, paid Mr. Gayler a total of $24,341. For hourly consulting services rendered from January 1, 2006 through August 31, 2006 the Company paid Mr. Gayler a total of $1,069 and Fairways Frisco, L.P., an entity in which the Company is a limited partner, paid Mr. Gayler a total of $39,877.

No grants under the 1999 Long-Term Incentive Plan or the 2002 Equity Incentive Plan were made to Mr. Gayler during fiscal 2006.

Gary W. Boyd. When Mr. Boyd was hired in October 2004, the Board approved an annual salary in the amount of approximately $150,000 be paid to Mr. Boyd, a signing bonus of $15,000 and a grant of 50,000 shares of restricted stock, such shares vesting equally over a period of three years on the anniversary date of Mr. Boyd's Restricted Stock Agreement.

In 2006, Mr. Boyd received an increase from his annual salary from approximately $150,000 to $180,000 and received 10,000 shares of restricted stock; this was determined by the Compensation Committee and agreed on by the Board.

Mr. Boyd resigned in September 2006. At that time, the remaining unvested shares of Mr. Boyd’s restricted stock, 43,334 shares, became vested for consulting with us for one year following his departure. No grants under the 1999 Long-Term Incentive Plan were made to Mr. Boyd during fiscal 2006.

Company Policy on Qualifying Compensation

The Board of Directors periodically reviews the applicability of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), which disallows a tax deduction for compensation to an executive officer in excess of $1.0 million per year. In connection with the Board's periodic review of the potential consequences of Section 162(m), the Board may, in the future, structure the performance-based portion of its executive officer compensation to comply with certain exemptions provided in Section 162(m).

Severance and Change In Control Agreements

We have not entered into any agreements that provide severance or change in control benefits to any of our named executive officers.

TABULAR COMPENSATION DISCLOSURE

Summary compensation

The following table provides summary information concerning compensation paid by us to our principal executive officers and each person who served as our principal financial officer in 2006. In 2006, no other person who served as an executive officer of Ascendant Solutions at any time during the year had total annual salary and bonus in excess of $100,000. In 2002, David E. Bowe's salary was reduced and he was awarded certain performance-based options and restricted stock, in part, in exchange for the reduction in salary to be paid to him.

SUMMARY COMPENSATION TABLE |

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock (1) Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

| | | | | | | | | | |

David E. Bowe President and Chief Executive Officer | 2006 2005 2004 | $127,917(2)$100,000 $100,000 | -- | | | | | -- -- $4,000(3) | $127,917 $100,000 $104,000 |

| | | | | | | | | | |

Michal L. Gayler Interim Chief Financial Officer | 2006 2005 2004 | $57,499(4) -- -- | | | | | | | $57,499 |

| | | | | | | | | | |

Gary W. Boyd, Former Vice President - Finance and Chief Financial Officer | 2006 2005 2004 | $115,935(5)$150,000 $31,250(7) | -- $15,000 | $4,300(6) -- $55,000(6) | | | | | $120,235 $150,000$101,250 |

| | | | | | | | | | |

| (1) | All of the stock awards are restricted. |

| (2) | Represents an increase in June of Mr. Bowe’s annual salary, from approximately $100,000 to $150,000 annually, for the fiscal year ended December 31, 2006. Mr. Bowe did not receive director compensation. |

| (3) | Represents the amount of matching contribution made by us in such fiscal year under our 401(k) Plan and in which our employees participated. |

| (4) | Mr. Gayler is paid on a contract basis as an Interim Chief Financial Officer. His salary represents payment from September to December 2006. |

| (5) | Represents an increase in May of Mr. Boyd’s annual salary, from approximately $150,000 to $180,000, and his departure from the Company in September 2006, for the fiscal year ended December 31, 2006. |

| (6) | Mr. Boyd was granted 10,000 and 50,000 shares of restricted common stock in 2006 and 2004, respectively, which would vest in three equal annual installments. Effective September 2006, all of Mr. Boyd’s restricted common stock became 100% vested for consulting with us for one year following his departure. As a result, the Company recognized an expense of $12,183 during 2006 related to this acceleration of vesting of the restricted stock. |

| (7) | Represents the portion of Mr. Boyd’s annual salary for the fiscal year ended December 31, 2004 since his employment commenced in October 2004. |

Option Grants in Last Fiscal Year

There were no option grants during the fiscal year ended December 31, 2006.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides information regarding options that were exercised during the fiscal year ended December 31, 2006, the number of shares covered by both exercisable and unexercisable stock options as of December 31, 2006, and the values of "in-the-money" options, which values represent the positive spread between the exercise price of any such option and the fiscal year-end value of our common stock for our named executive officers.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

| | Option Awards | Stock Awards |

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

| | | | | | | | | | |

David E. Bowe President and Chief Executive Officer | 450,000 | -- | -- | $0.24 | 3/14/2012 | -- | -- | -- | -- |

| | | | | | | | | | |

Michal L. Gayler Interim Chief Financial Officer | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| | | | | | | | | | |

Gary W. Boyd Former Vice President -Finance and Chief Financial Officer | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| | | | | | | | | | |

The following table provides information, for the named executive officers, on stock option exercises and stock awards vested during 2006.

OPTION EXERCISES AND STOCK VESTED |

| | Option Awards | Stock Awards |

| | Number of Shares Acquired on Exercise (#) | Value Realized On Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized On Vesting ($) |

| | | | | |

| David E. Bowe | -- | -- | | |

| Michal L. Gayler | | | | |

| Gary W. Boyd | | | 43,333 | $18,633 |

COMPENSATION COMMITTEE REPORT

Compensation Committee InterlocksReport

The information contained in the Compensation Committee Report shall not be deemed to be "soliciting material" or to be "filed" with SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

The Compensation Committee of Ascendant Solutions, Inc. has reviewed and Insider Participationdiscussed with management the Compensation Discussion and Analysis for fiscal 2006. Based on the review and discussions, the Compensation Committee recommended to the Board of Directors, and the Board of Directors has approved, that the Compensation Discussion and Analysis be included in Ascendant Solutions, Inc.’s Proxy Statement for its 2007 Annual Meeting of Stockholders.

This report is submitted by the Committee.

Compensation Committee

Curt Nonomaque, Chairman

Anthony J. LeVecchio

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Board has appointed a Compensation Committee consisting of Jonathan R. BlochCurt Nonomaque and Anthony J. LeVecchio. The Compensation Committee had no formal meetings in person during 2005;2006, but met once by unanimous consent; instead the full board performed those functions. The Compensation Committee studies, advises and consults with management respecting the compensation of our officers, and administers our stock-based compensation plans. It also recommends for the board's consideration any plan for additional compensation that it deems appropriate. During the last fiscal year, no executive officer or employee of Ascendant Solutions served as a member of the Compensation Committee. However, since the Compensation Committee did not meet and the full board performed these functions, bothJames Leslie and David E. Bowe and James Leslie participated in the board's deliberations concerning executive compensation, however, neither receivedcompensation. James Leslie did not receive an increase in compensation, although David E. Bowe and Gary Boyd both received increases in their compensation in 2005.2006.

During the fourth quarter of 2003, the Company entered into a participation agreement (the “Participation Agreement”) with Fairways Equities LLC (“Fairways”), an entity controlled by JimJames Leslie, the Company’s Chairman, and Brant Bryan, Cathy Sweeney and David Stringfield who are principals of CRESA Capital Markets Group, LP (“Capital Markets”) and shareholders of the Company (“Fairways Members”), pursuant to which the Company will receive up to 20% of the profits realized by Fairways in connection with all real estate acquisitions made by Fairways. Additionally, the Company will have an opportunity, but not the obligation, to invest in the transactions undertaken by Fairways. The Company’s profit participation with Fairways iswas subject to modification or termination by Fairways at the end of 2005 in the event that the aggregate level of cash flow (as defined in the Participation Agreement) generated by the acquired operating entities hashad not reached $2 million for the twelve months ended December 31, 2005. For the twelve months ended December 31, 2005, the Company did not meet this cash flow requirement and there has been no action taken by the Fairways Members to terminate or modify the Participation Agreement. The Company is currently negotiating with the Fairways Members to modify the Participation Agreement, however, there can be no assurances that a mutually acceptable modification can be reached. The Company is unable to determine what real estate Fairways may acquire or the cost, type, location, or other specifics about such real estate. There can be no assurances that Fairways will continue to waive its right to modify or terminate the Company will be ableParticipation Agreement upon the Company’s failure to generate the required cash flow to continue in the Fairways Participation Agreement after 2005, or that Fairways will be able to acquire additional real estate assets, that the Company will choose to invest in such real estate acquisitions or that there will be profits realized by such real estate investments. The Company does not have an investment in Fairways, but rather a profits interest through its Participation Agreement. As of December 31, 2005, the Company held a profits interest in one real estate development transaction pursuant to the Participation Agreement. The Company has no investment in the transaction, is not a partner in the investment partnership and it has received no distributions.

During the year ended December 31, 2005, Capital Markets a subsidiary of the Company received approximately $108,000 in cash advances from the Fairways Members, which were used to pay general operating expenses. These non-interest bearing advances were repaid in full in December 2005 from the receipt of revenues from Capital Markets real estate advisory transactions.

Mr. James C. Leslie, the Company’s Chairman, controls, and Mr. Will Cureton, one of ourthe Company’s directors, is indirectly a limited partner in the entity that owns the building in which the corporate office space is leasedsub-leased by Ascendant and its wholly-owned subsidiary, Dougherty’s Holdings, Inc. (“DHI”). Also, through August 2005, Capital Markets paid rent for office space in the same building to an entity controlled by Mr. Leslie. DHI. The Company considers all of these leases to be at or below market terms for comparable space in the same building. Beginning on March 16, 2005 and ending on October 13, 2006, Ascendant subleased space from an unrelated third party of approximately $7,000 per month. In October 2006, Ascendant began sharing office space with DHI. During the year ended December 31, 2005, Ascendant and Capital Markets paid rent of approximately $26,000 directly to an entity controlled by Mr. Leslie. The remaining rent expense paid by Ascendant and2006, DHI is paid under sublease agreements withsubleased space from an unrelated third party and approximates $13,000 monthly. The Company also incursfor $6,000 per month. In addition, Ascendant incurred certain shared office costs with an entity controlled by Mr. Leslie, which gives rise to reimbursements from the Company to that entity. These costs were approximately $24,300$9,000 in 2005.2006.

During the year ended December 31, 2005,2006, the Company paid fees to its directors of $8,750,$2,500 in exchange for their roles as members of the board of directors and its related committees. Additionally, in May 2005,During 2006, the Company issued 22,50099,770 shares of restricted stock to directorsa director in lieu of cash fees for their roleshis role as members of the board of directors and its related committees for the year ended December 31, 2005.2006. These restricted shares vested ratably atover the endthree month period after the date of each quarter ending June, September and December 2005, respectively.issuance. In July 2006, the Company issue 7,500 share of restricted stock to a director, for his annual restricted stock grant, which vests ratably over a three year period from the date of issuance. In July 2006, the Company issued 10,000 share of restricted stock to a newly elected director as his initial grant of restricted stock. This initial grant of restricted stock also vests ratably over a three year period from the date of issuance.

The Company acquired CRESA Partners of Orange County, LP (“CPOC”)CPOC on May 1, 2004 and in connection with that acquisition, it entered into the Acquisition Note Payable withassumed a $500,000 note payable to Kevin Hayes, who is currently the Chairman of CPOC.CPOC, and it entered into the Acquisition Note with Mr. Hayes. During the year ended December 31, 2005,period from January 1, 2006 to June 2006, CPOC paid $1,198,000approximately $1,108,000 to Mr. Hayes for principal and interest under the assumed note and the Acquisition Note. In June 2006, ASDS entered into a credit agreement with First Republic Bank for a $5.3 million term note. The proceeds from the term note were used to retire the outstanding balance owed to Kevin Hayes under the Acquisition Note Payable.pursuant to the acquisition of CPOC in 2004 by the Company (through ASDS). The Acquisition Note was retired at a discount of approximately $100,000 to its outstanding principal balance of $5,400,000.

Mr. Leslie, the Company’s Chairman, also serves as an advisor to the Board of Directors of CRESA Partners, LLC, a national real estate services firm. Also, Kevin Hayes, the Chairman of CPOC servesserved as the Chief Executive Officer of CRESA Partners, LLC.LLC from October 2005 to September 2006. Both Capital Markets and CPOC have entered into licensing agreements with CRESA Partners, LLC. During 2005,2006, Capital Markets and CPOC paid approximately $261,500$339,662 combined to CRESA Partners, LLC.

In March 2006, CPOC purchased a minority interest of approximately 2.7% in CRESA Partners, LLC. The amount paid for this investment was approximately $160,000 and is accounted for under the cost method of accounting for investments. CPOC is a licensee of CRESA Partners, LLC.

The Company made an investment in Fairways 03 New Jersey, LP in December 2003, along with the Fairways Members and on substantially the same terms as the other limited partners in Fairways 03 New Jersey, LP. In January 2005, the Company agreed to indemnify the other partners of Fairways 03 New Jersey, LP (who are also the Fairways Members) for its 20% pro rata partnership interest of a guarantee of bank indebtedness which the partners provided to a bank. The limit of the Company’s indemnification under this agreement is $520,000. In December 2005, this bank debt was paid in full by Fairways 03 New Jersey LP and the Company’s limited indemnification agreement was cancelled.

Effective September 1, 2005, Capital Markets entered into an advisory services agreement with Fairways Equities whereby Fairways Equities will provide all of the professional and administrative services required by Capital Markets. In exchange, Capital Markets will pay Fairways Equities an administrative fee of 25% of gross revenues and a compensation fee of 40% of gross revenues, as compensation to the principals working on the transaction that generated the corresponding revenues. Under the terms of the agreement, Fairways Equities assumed all of the administrative expenses, including payroll, of Capital Markets. Fairways Equities will only receive payments under the agreement if the Fairways Members close a real estate capital markets advisory transaction that generates revenue for Capital Markets. The impact of this agreement on Capital Markets is that it will have no administrative expenses or cash requirements unless it closes a revenue generating transaction. The principals in Capital Markets are also the four members of Fairways Equities. During the year ended December 31, 2005,2006, Capital Markets paid compensation fees to Fairways Equities under the advisory services agreement of approximately $233,000.$262,000.

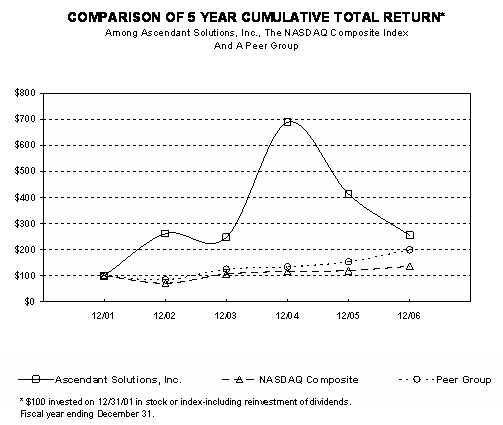

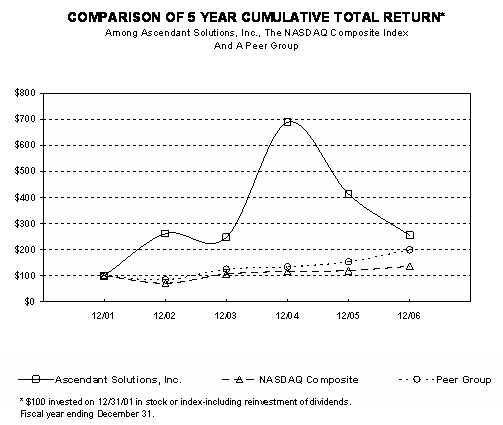

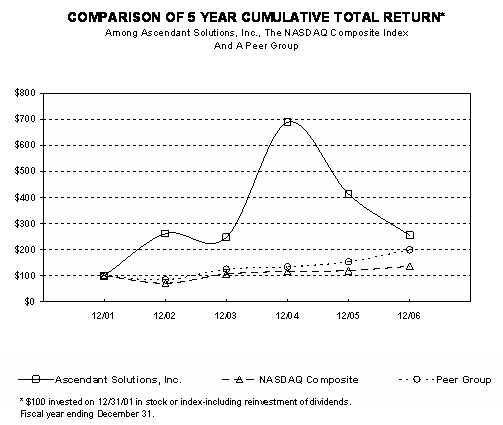

The Company has made cumulative cash investments of $1.22 million for limited partnership interests in Fairways Frisco, L.P. Fairways Frisco is the majority limited partner in the Frisco Square mixed-use real estate development in Frisco, Texas. The general partner of Fairways Frisco is Fairways Equities, which is an affiliate of the Company. Additionally, the Fairways Members, or certain of their affiliates, have purchased limited partnership interests in Fairways Frisco on the same terms as the interests purchased by the Company.